mojaRBA mobile banking

mojaRBA

-

Simplicity of payments

Pay securely wherever you are.

-

Control of expenses and incomes

Monitor and manage your costs easily.

-

Personalization of account display

Adjust the display to your needs.

Life is easier when some of the important activities are online

mojaRBA mobile banking is a safe and simple way to take care of your daily payments on the go, from any location. Download the free app and, when it comes to payments to either friends or various institutions, and completely forget about branches, teller's counters and queuing.

mojaRBA App Functionalities

-

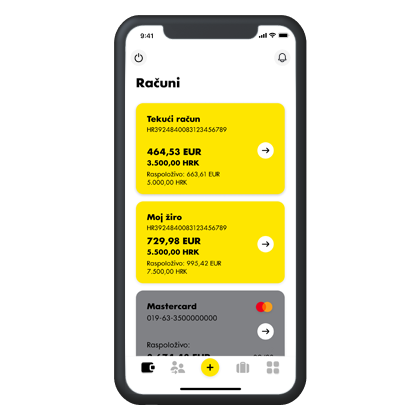

Accounts

• Personalize account display (change the display or hide an account on the list).

• For easier recognition, name your accounts as you like.

• Simply check the collected points in the Zlatna RBICA loyalty programme and replace them for the euro. -

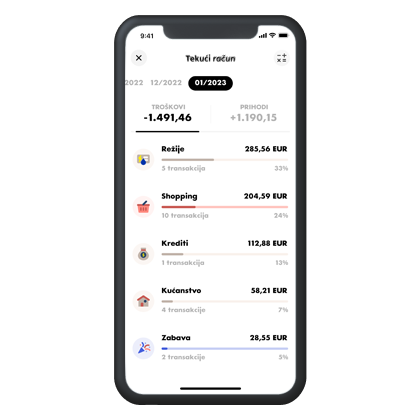

Control of expenses

• Monitor the balance, transactions and details of accounts, cards and loans.

• View the expense statistics by categories.

• Split every payment with the RBA credit credit cards of 40,00 EUR or more at zero interests, in 2 to 24 installments, at a one-of 1,99 EUR fee. -

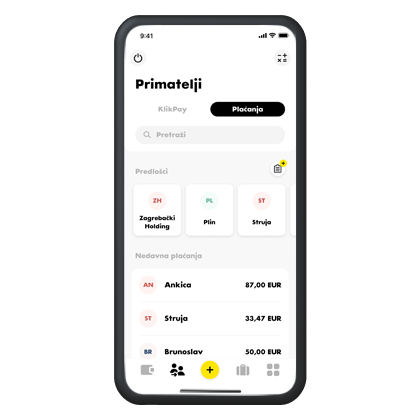

Payments

• Pay invoices with the FotoNalog (scan it or pay with barcode uploaded from your photo gallery).

• Pay your contacts with the KlikPay option, regardless of the bank at which they hold their account.

• Use templates or recent payments to create a new order easily. -

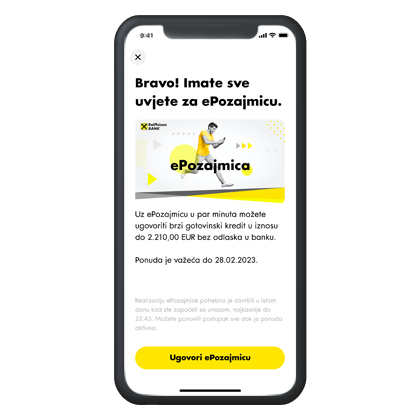

Personalized offers

• If you meet the criteria and receive an offer to contract an ePozajmica and/or eKartica, realize them through the mojaRBA app fast and simple, without coming to a branch.

-

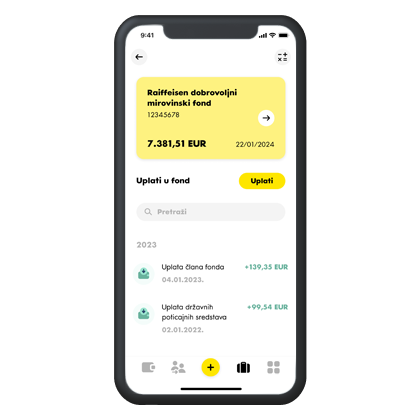

Savings

• Pay and monitor the balance and movements in your deposit and/or Raiffeisen Voluntary Pension Fund simply.

Best Buy Award

Naše digitalne bankarske usluge dobile su Best Buy Award priznanje!

Saznajte više

mojaRBA App Is Always" New"

Taking no rest, we work on adding new functionalities and with every app update, you get more options for better management of your money.

How to Contract mojaRBA?

Simply! mojaRBA mobile banking can be agreed:

• in the mojaRBA app by selecting "Video Call Activation", after installing the app on your mobile phone,

• at a branch.

| RBA On-line banking (mojaRBA mobile banking) registration fee | free of charge |

| RBA On-line banking (mojaRBA mobile banking) monthly fee | 1,46 EUR |

| Fee | Via On-line banking (RBA mobile banking) | In the branch |

| National EUR credit transfer to account of legal entity at the bank | 0,27 EUR | 1,30% of payment amount minimum 1,59 EUR maximum 17,25 EUR |

National EUR credit transfer to accounts in other banks in Croatia | 0,35% of payment amount

| 1,30% of payment amount minimum 1,59 EUR maximum 17,25 EUR |

| National EUR credit transfer to accounts in other banks in Croatia using KlikPay service | 0,00 EUR | not applicable |

Tariff overview is available at Transaction fees for Private individuals.

Need any help?

The mojaRBA app instruction manual is here. And, should you have any other questions, feel free to call us at 072 62 62 62 or write to us at info@rba.hr.

We wish you a pleasant experience with mojaRBA mobile banking!

APPLICATION DOWNLOAD

Support

RBA INFO

Call us on our info line

Send us an e-mail to

Branch network

Find the nearest branch

Zatražite online i ostale proizvode

U našoj online ponudi nalaze se i drugi proizvodi koji bi vam mogli biti od koristi i koje možete ugovoriti ili zatražiti online.

Posjetite ePoslovnicu