MAKE THE GOLDEN YEARS happen RBA Senior current account package

Mobile and internet banking

Digitalni alati za jednostavno upravljanje financijama s lokacije koja vama odgovara

Free cash withdrawal

1,000+ RBA and Euronet ATMs

Additional resources

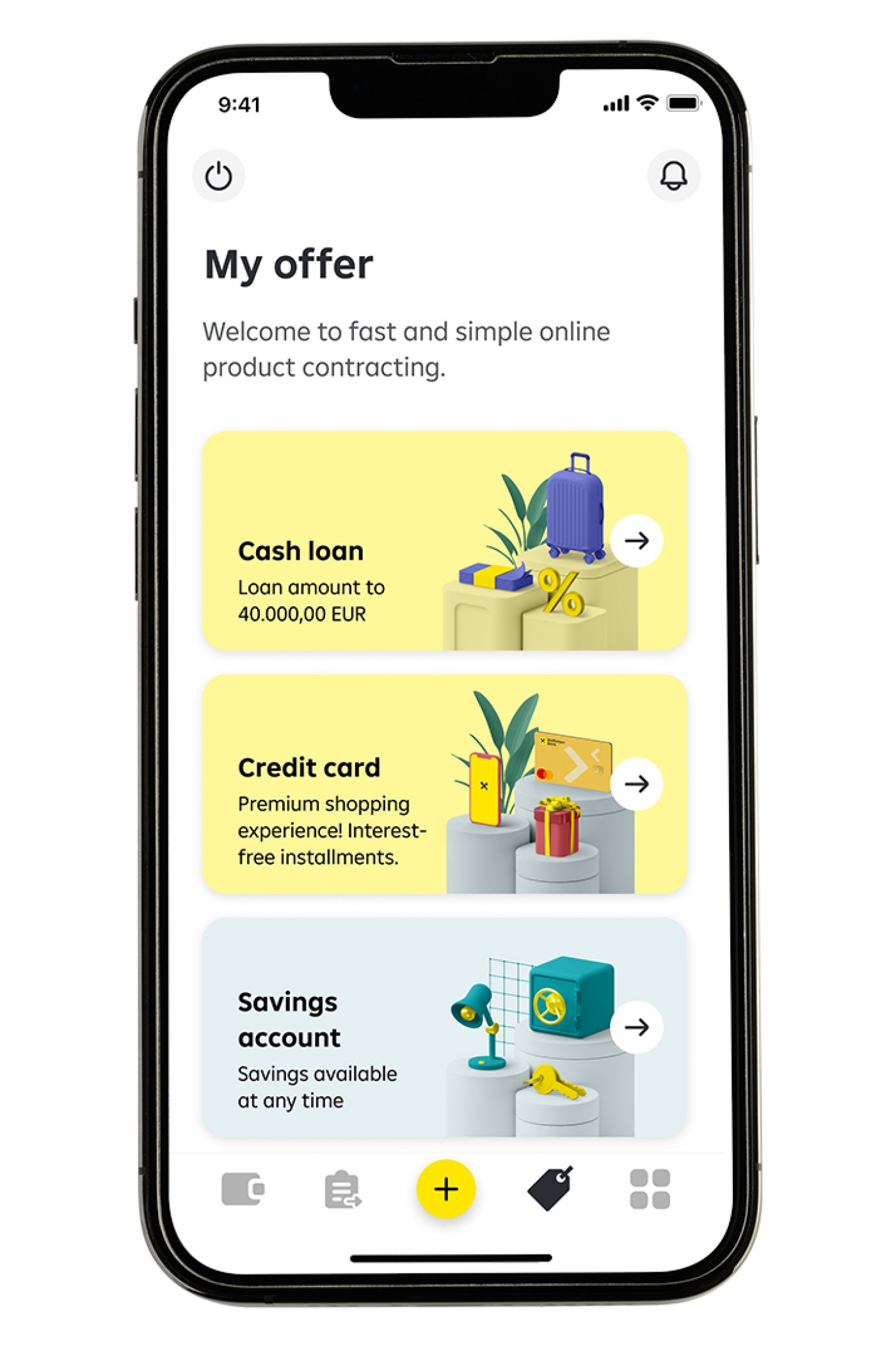

The possibility of using overdrafts and contracting loans for retired persons

RBA SOLUTION IN RESPONSE TO YOUR NEEDS RBA Senior current account package

4 EUR/mo.

Accounts and cards

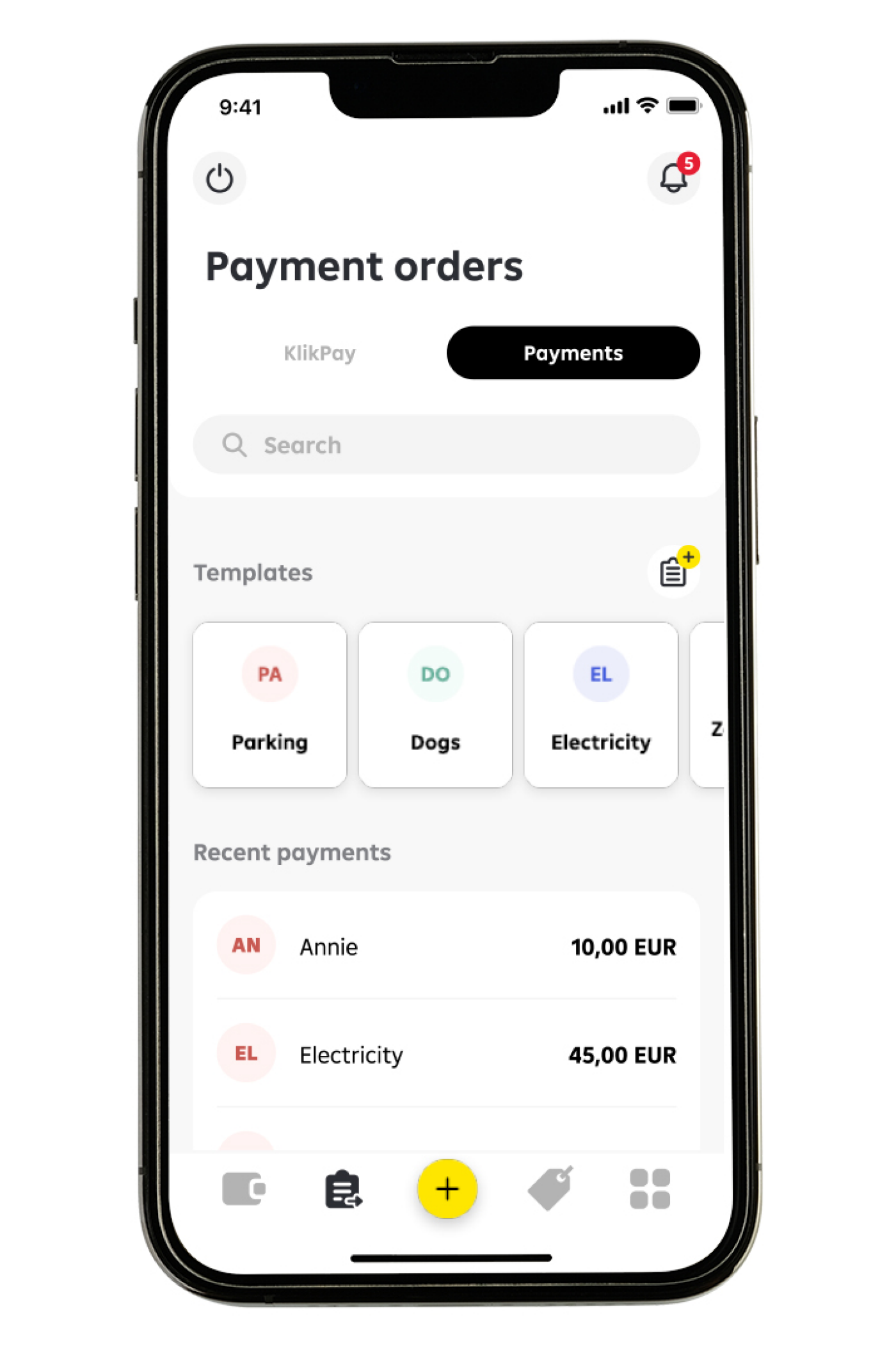

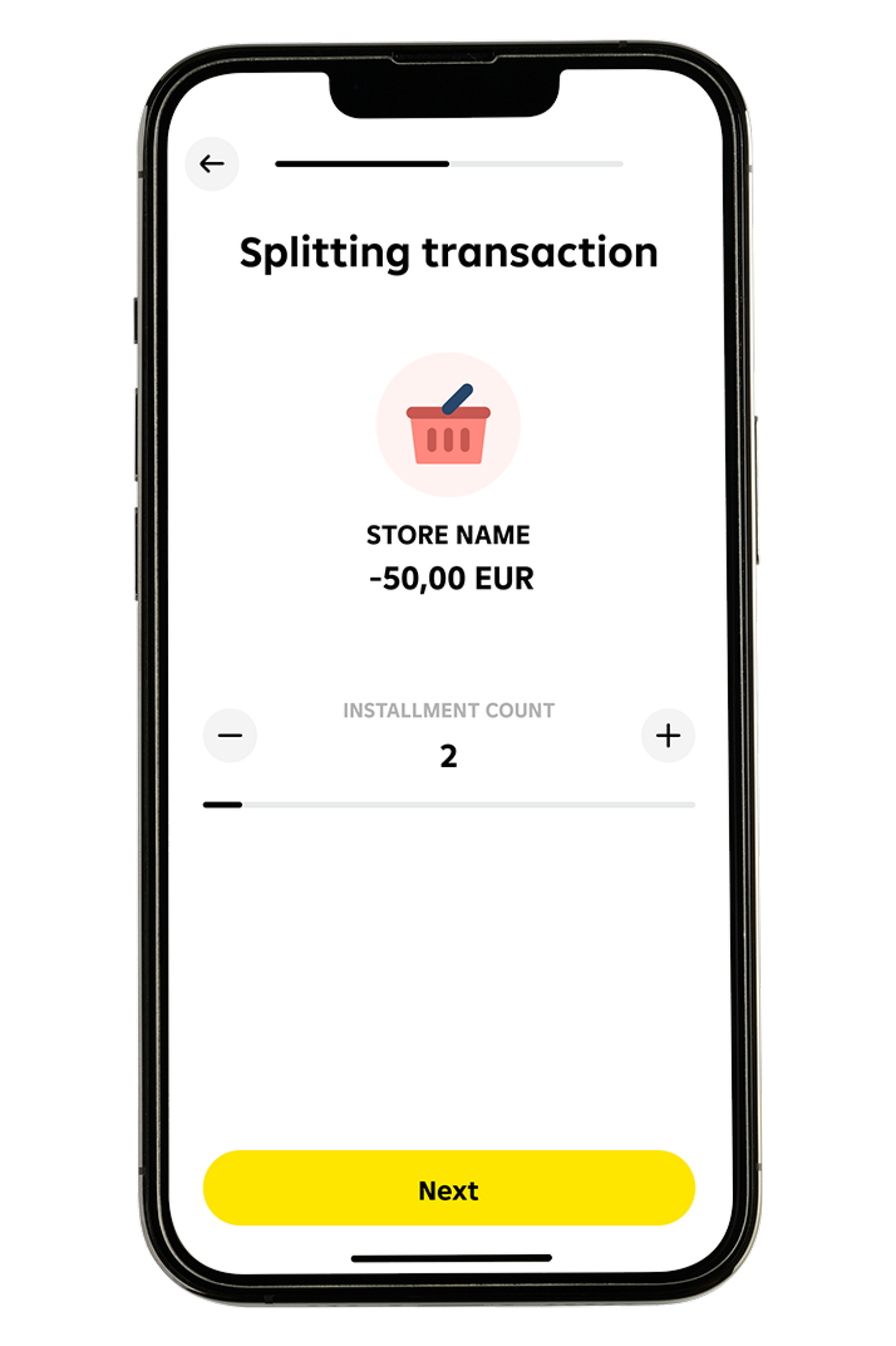

Digital banking and payments

Additional benefits and insurances

HAVE YOU DECIDED TO BECOME THE CAPTAIN OF YOUR OWN FINANCIAL SHIP? How to get the RBA Senior package?

Prepare a valid identification document – ID card or passport and a valid document or pension stub or Decision on Pension

Find the nearest branch office and make an appointment

Our employees are waiting for you, and you can arrange an overdraft with them during the same visit

SOME DREAMS AGE LIKE FINE WINE – THE OLDER THEY ARE, THE BETTER! Loan for pensioners

Regardless of whether you dream of a trip, a home renovation or anything else your heart desires, a non-purpose loan is here to support you. At competitive interest rates, this loan gives you the opportunity to realize those unfulfilled desires.

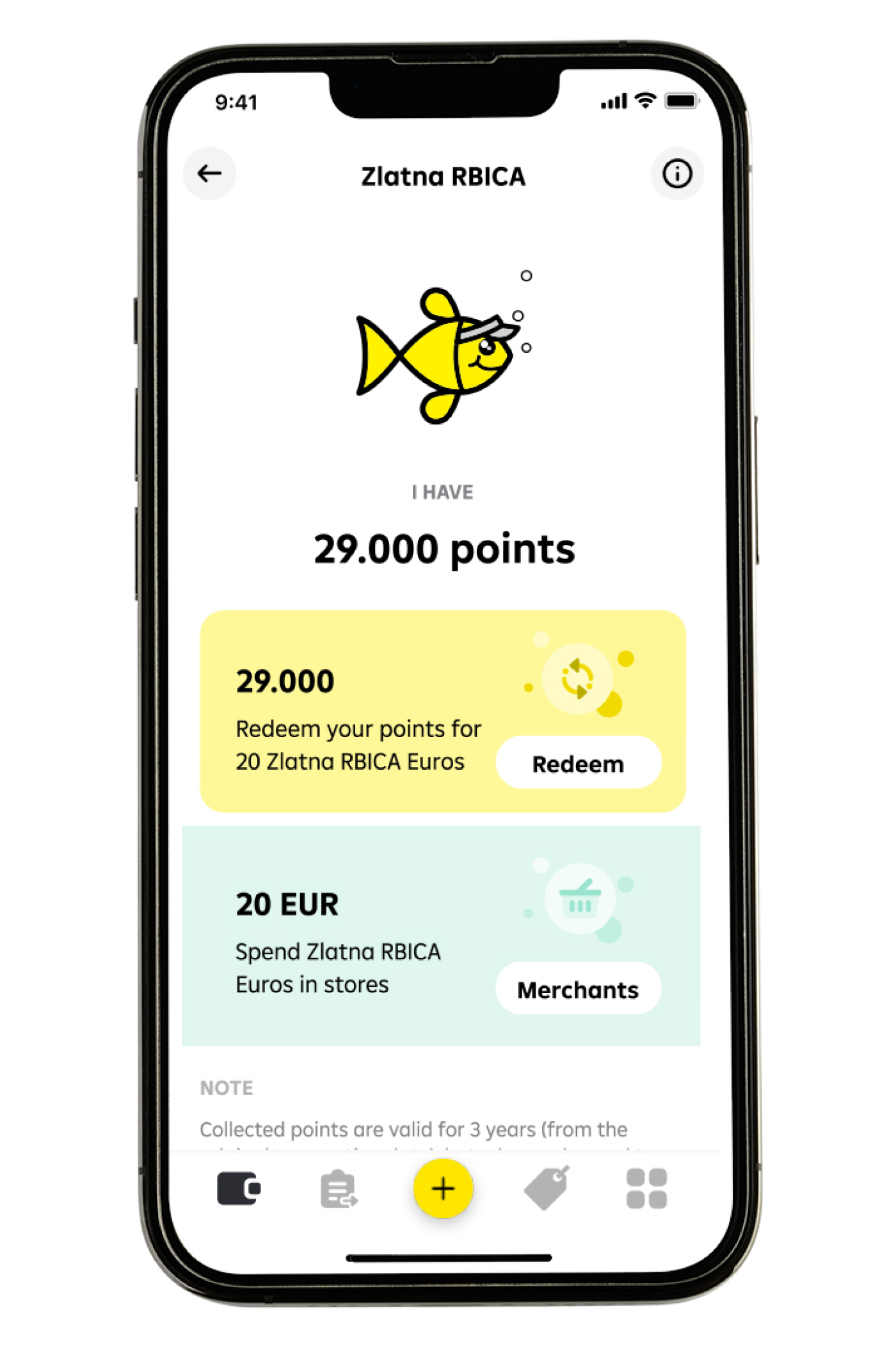

We reward your every purchase Zlatna RBICA loyalty program

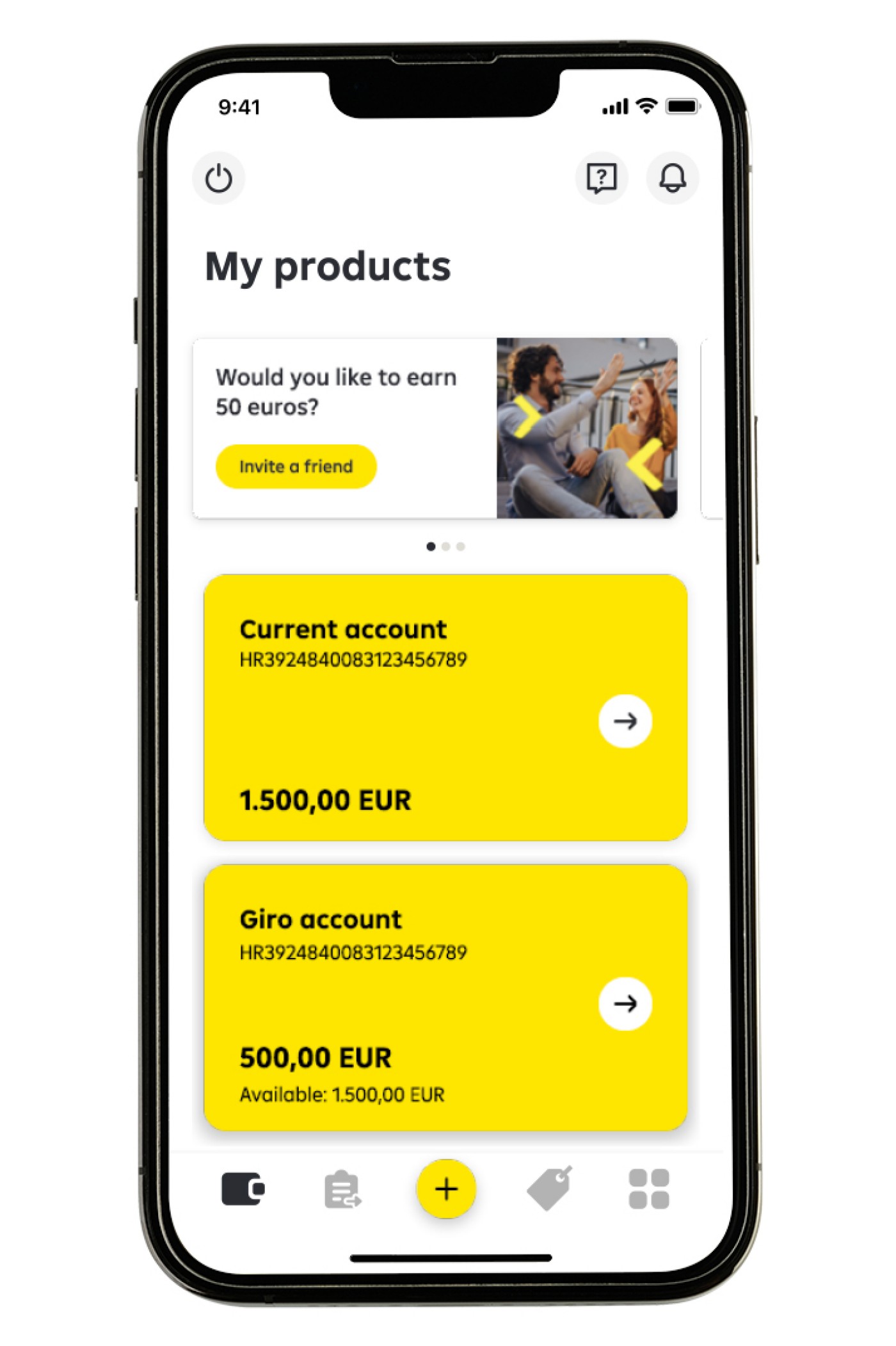

mojaRBA - a mobile app for which you will not need instructions

Mobile banking is part of every RBA current account package, and it can be arranged online or in a branch.

PRACTICAL SUPPORT FOR EVERYDAY LIFE Additional insurance services

ORYX House Assistance

UNIQA insurance in case of death due to an accident

Schedule a meeting

FAQ

Find answers to the most frequently asked questions.

The RBA Senior package can be contracted by clients who have or will open a current account in the bank for receiving pension/disability benefits and have a valid identification document – identity card or passport.

Yes, there is a single price for all services and products included in the package. If you want to use services and products that are not included in the RBA Senior package, you can contract them separately or you can contract another current account package that contains the products and services you are interested in.

You can contract the RBA Senior package at the nearest RBA office.

When opening the RBA Senior package at the branch office, your package will be opened immediately and you will receive all the necessary documentation from our employee.

We send the debit card and PIN to your home address in separate shipments, and you will receive them within 7 to 10 days max.

You can check your account balance at any RBA and Euronet ATM, in the nearest branch office, and via mojaRBA mobile and internet banking.

You can activate the mojaRBA app as soon as your account is opened. When opening an account in the branch office, please emphasize to the employee that you want to contract and activate mobile banking immediately.

Activation is simple, and all you need is the activation code, which you will receive in two parts – the first part by e-mail (from the employee at the branch office), and the second part via SMS.

RBA Senior includes the possibility of using an overdraft. You can submit an overdraft approval request at the nearest RBA branch office.

Useful documents

Find useful contracting documents and useful information.

Find other valid documents at the link:

Do you wish only to open a current account without additional services?

You can opt for additional services or change the service package at any time.

You can open a current account online.