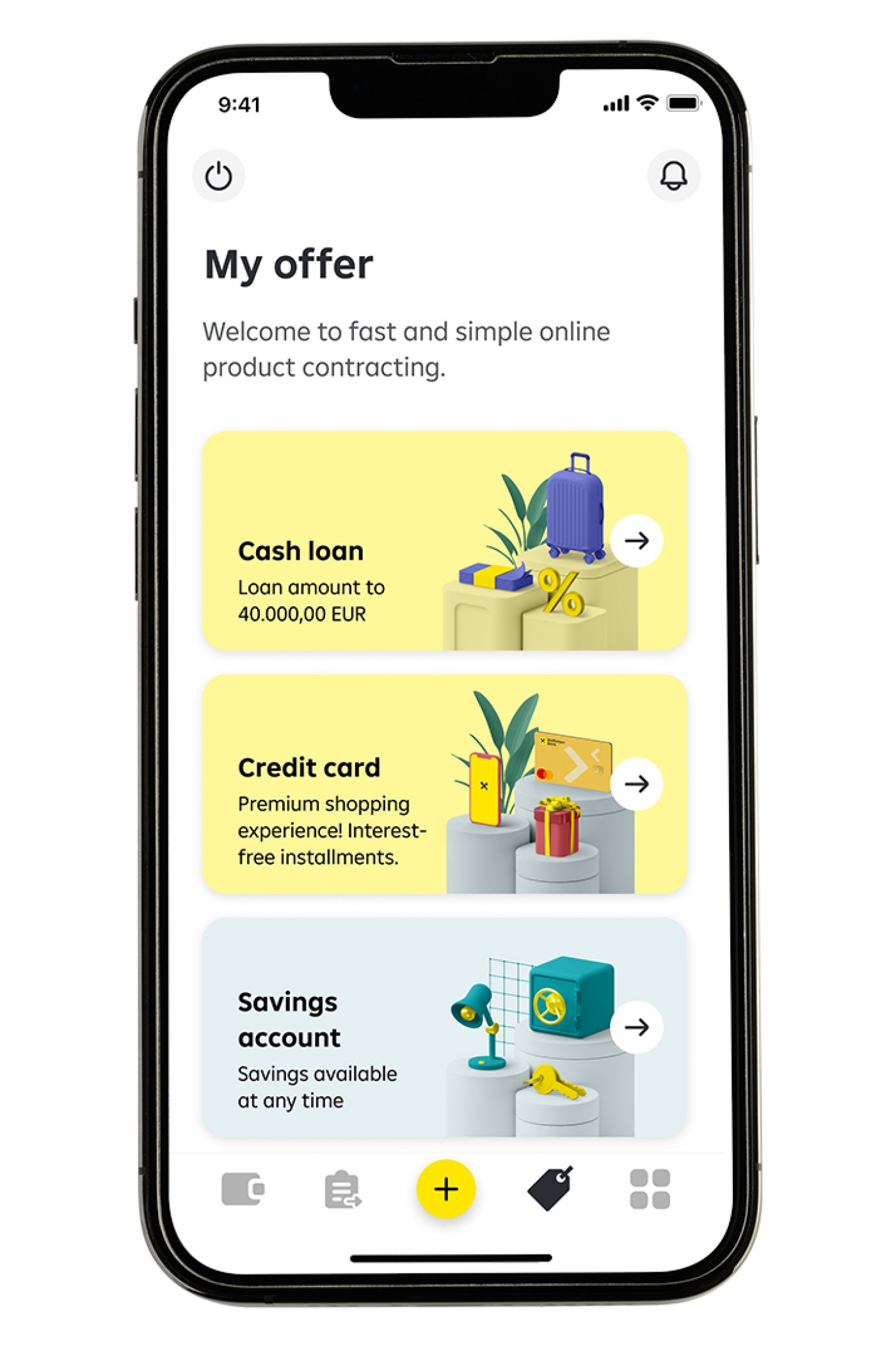

Mastercard Gold

0,00 EUR

annually

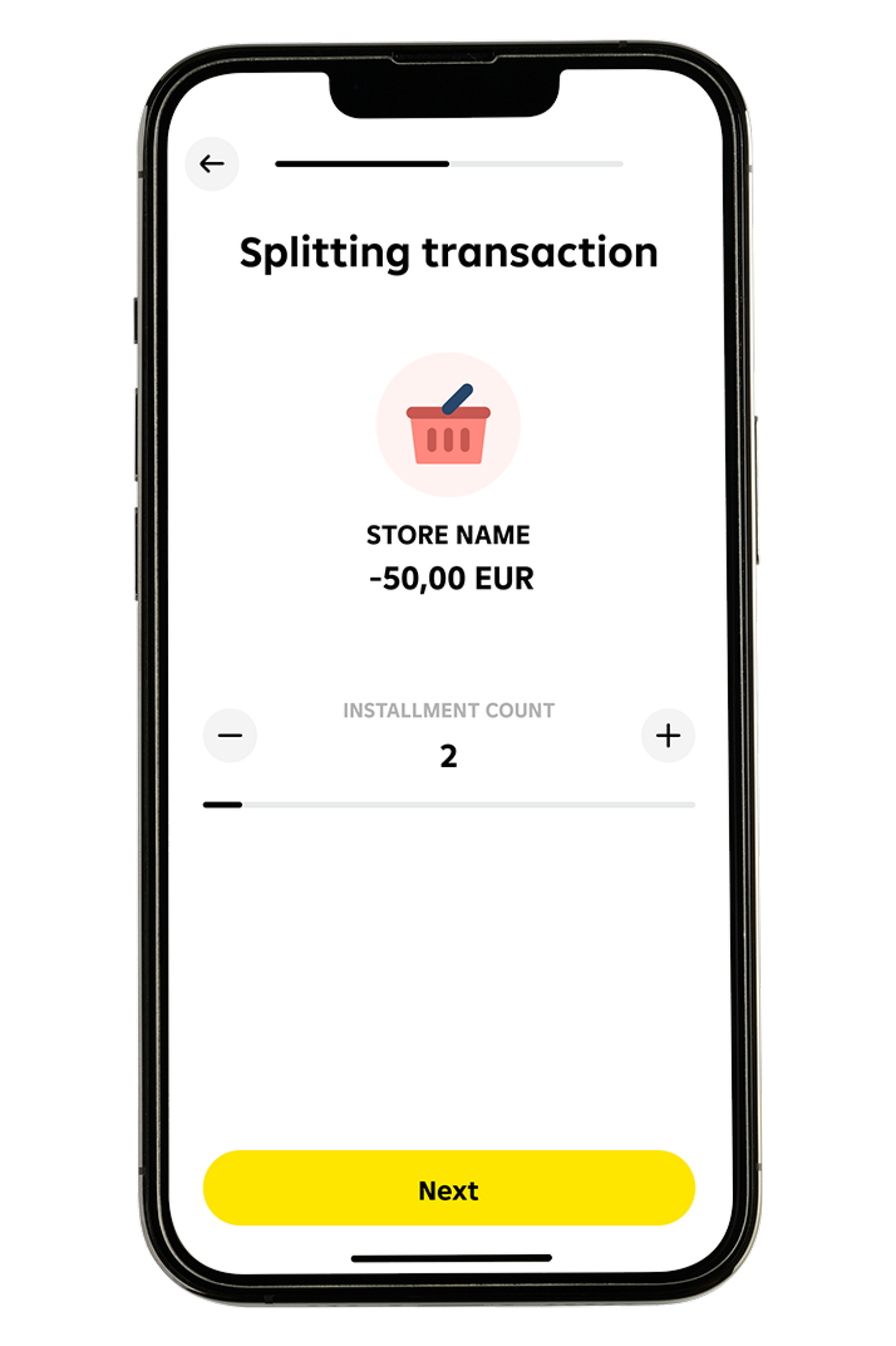

- options to use it as a charge and/or revolving card

- purchase in instalments

- secure online payment by the highest Mastercard standards

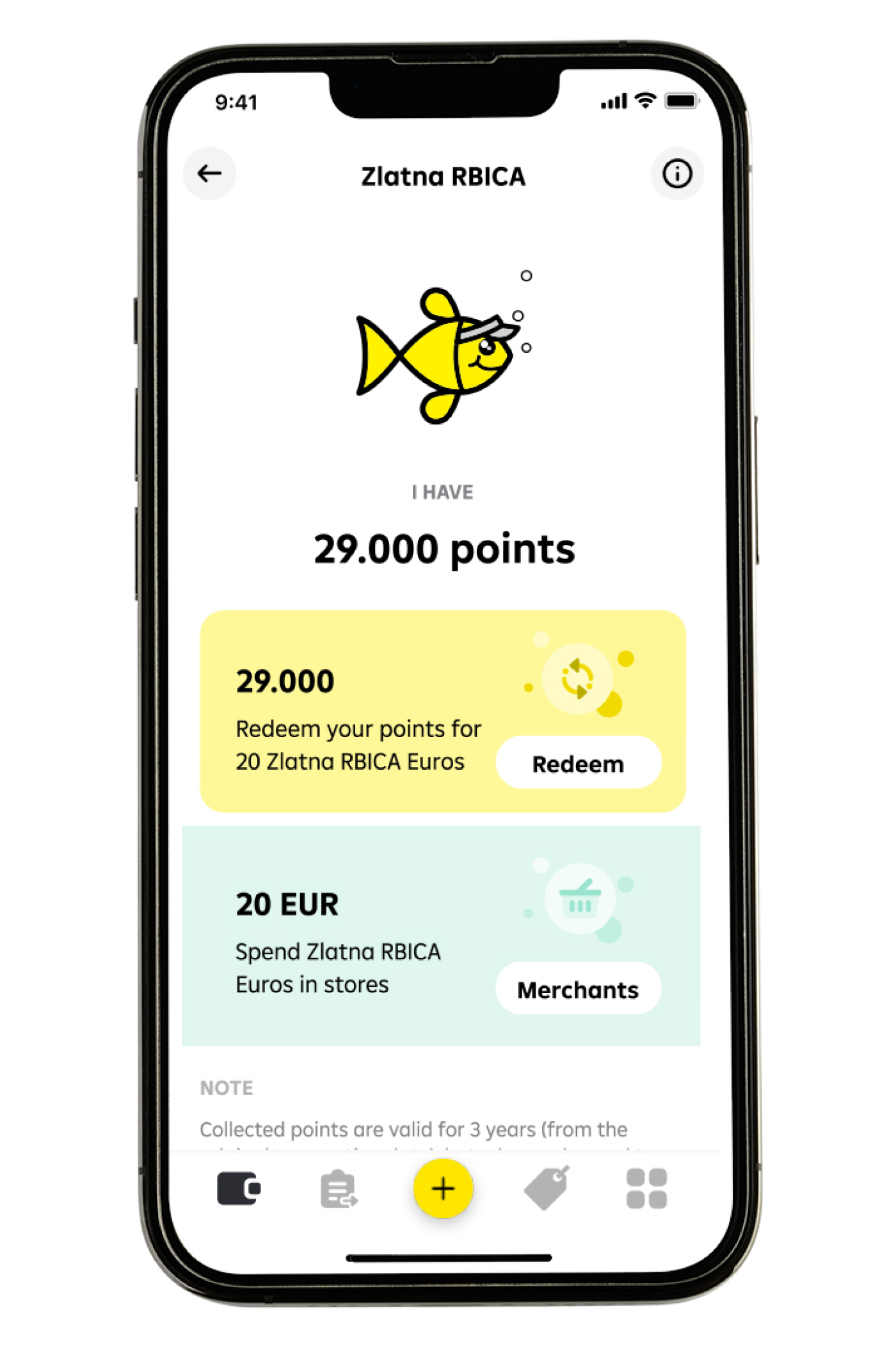

- Zlatna RBICA loyalty program

- contactless payment with mobile wallet with RaiPay or Apple Pay

- possibility to contract additional benefits:

- Mastercard PLUS - UNIQA Travel Insurance Policy with Accidental Death Coverage – EUR 13,27 annually

- Mastercard Gold PLUS - UNIQA Travel Insurance Policy with Accidental Death Coverage and Oryx Road Assistance for EUR 53,09 annually